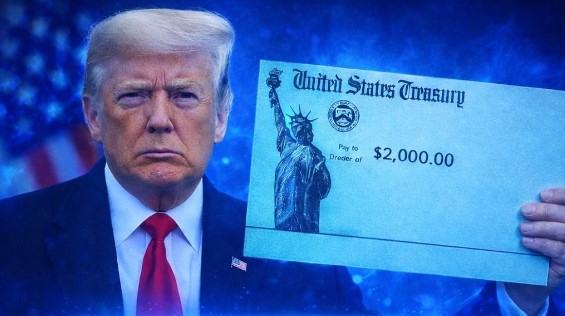

Former President Donald Trump has drawn renewed national attention after publicly commenting on the timing of potential $2,000 relief payments, remarks that quickly spread across social media and online news platforms. While the statement generated widespread interest and speculation, federal officials and policy experts emphasized that no new nationwide payment program has been formally approved or scheduled.

Trump’s comments, made during a recent appearance and later amplified online, suggested that a future administration could move quickly to deliver direct financial assistance to Americans. Supporters interpreted the remarks as a sign of continued focus on economic relief, particularly for households facing persistent financial pressure. However, government agencies have not confirmed any legislation or administrative action that would authorize such payments at this time.

The reaction underscores how deeply the idea of direct payments remains embedded in the public consciousness. For many Americans, stimulus checks issued during the pandemic became a financial lifeline, helping cover essential expenses such as housing, food, utilities, and medical costs. As living expenses continue to rise in many parts of the country, even unconfirmed statements about potential relief can spark intense public interest.

Following Trump’s remarks, online discussions surged. Social media posts and financial forums were filled with questions about eligibility, payment methods, and timelines. Some users assumed a specific date had been finalized, while others expressed skepticism, noting that previous stimulus efforts required extensive legislative negotiation.

Policy analysts were quick to clarify that any large-scale distribution of federal funds would require congressional approval. Regardless of who proposes it, a relief program involving direct payments must pass through Congress, be signed into law, and then be implemented by federal agencies such as the Treasury Department and the Internal Revenue Service.

“There is currently no enacted law that authorizes new $2,000 checks,” said one budget policy expert familiar with federal relief programs. “Announcements or statements alone do not create a payment program. The legal and administrative process is essential.”

This distinction is critical, economists say, because past relief efforts illustrate how complex such programs can be. During earlier stimulus rounds, lawmakers debated payment amounts, income thresholds, dependent eligibility, and delivery systems. Even after legislation passed, some recipients experienced delays due to outdated information or processing backlogs.

Federal agencies responsible for administering payments have not indicated that preparations are underway for a new distribution. Neither the Treasury Department nor the IRS has issued guidance suggesting that additional checks are imminent. Officials have urged the public to rely on official government announcements rather than headlines or social media claims.

The conversation surrounding Trump’s remarks also reflects broader political dynamics. Economic relief remains a powerful theme in American politics, particularly during election cycles. Direct payments, in particular, are easily understood by voters and can symbolize immediate government action during periods of economic stress.

Political strategists note that discussing financial assistance can resonate strongly with working families, retirees, and individuals living paycheck to paycheck. Even without concrete policy details, such messaging can shape public expectations and influence political narratives.

At the same time, economists caution that the economic landscape has shifted since the pandemic-era stimulus programs. Inflation, interest rates, and federal debt levels are now central considerations in policy debates. Some lawmakers have argued that broad direct payments could contribute to inflationary pressure if not carefully designed.

Others counter that targeted relief remains necessary for specific groups, such as low-income households or families facing rising housing and healthcare costs. These debates continue in Congress, though no consensus has emerged around another round of universal payments.

Consumer advocacy organizations have also weighed in, warning that unverified claims about government payments can create confusion and increase the risk of fraud. In recent years, scammers have used false promises of stimulus funds to target vulnerable individuals, often requesting personal information or upfront fees.

“When people hear about potential payments, they should be cautious,” said a spokesperson for a national consumer protection group. “Legitimate government programs are announced through official channels, and no one should be asked to pay to receive federal assistance.”

Despite the lack of confirmation, the discussion highlights ongoing concerns about financial security. Surveys show that many Americans continue to report difficulty covering unexpected expenses, even as employment levels remain relatively strong. Rising costs for housing, groceries, and insurance have strained household budgets, particularly for those on fixed incomes.

For these individuals, the idea of direct payments represents more than temporary relief. It symbolizes recognition of economic stress and a sense that policymakers understand the challenges facing everyday Americans.

Local officials and community leaders have encouraged residents to remain informed and patient. They stress that verified information will come from Congress or federal agencies, not from social media speculation or partisan headlines.

“If Congress passes a bill and it’s signed into law, people will know,” said one former Treasury official. “Until then, it’s important to separate proposals and political statements from actual policy.”

As of now, no legislation authorizing new $2,000 checks has been introduced or approved. Lawmakers from both parties continue to debate broader economic strategies, including tax policy, social spending, and targeted assistance programs.

Whether direct payments reemerge as part of those discussions remains uncertain. What is clear is that the topic continues to capture public attention, reflecting lingering economic anxiety and the enduring appeal of straightforward financial support.

For now, experts advise Americans to treat claims about specific payment dates with caution. Any future relief program would require formal legislative action, detailed implementation plans, and official announcements before funds could be distributed.

Until such steps occur, no timeline can be considered final.

The renewed attention surrounding Trump’s remarks serves as a reminder of how closely Americans follow discussions about economic relief. In a climate shaped by rising costs and political uncertainty, even preliminary statements can quickly dominate the public conversation.

As the debate continues, officials emphasize the importance of accurate information, responsible reporting, and reliance on verified sources. For millions of Americans watching closely, clarity — not speculation — remains the most valuable currency.